IVA (VAT) is the single most important form of taxation in Paraguay. According to figures published by DNIT, Paraguay’s tax authority, this tax represents around 70% of all government tax revenue.11 Locally, it’s called “IVA” (Impuesto al Valor Añadido), and it’s one of the key things to understand when relocating your tax residency or moving to Paraguay.

VAT applies to all for-profit transactions involving goods and services, with very few exceptions. As always, since Paraguay has a territorial tax system, IVA only applies to local transactions. Most products and services are subject to a 10% VAT, while rents, real estate sales, and interest are taxed at a reduced 5%. In certain situations, invoices can be exempt from VAT—such as when the buyer is a foreign tourist or the service is a digital export.

How VAT Works in Paraguay

Every time you buy something in Paraguay, you’re paying two things: the product price and IVA. For example, if you buy shoes for $110, you’re really paying $100 for the shoes and $10 in VAT. It’s a consumption tax: the customer pays it at purchase, and the seller later remits it to the State.

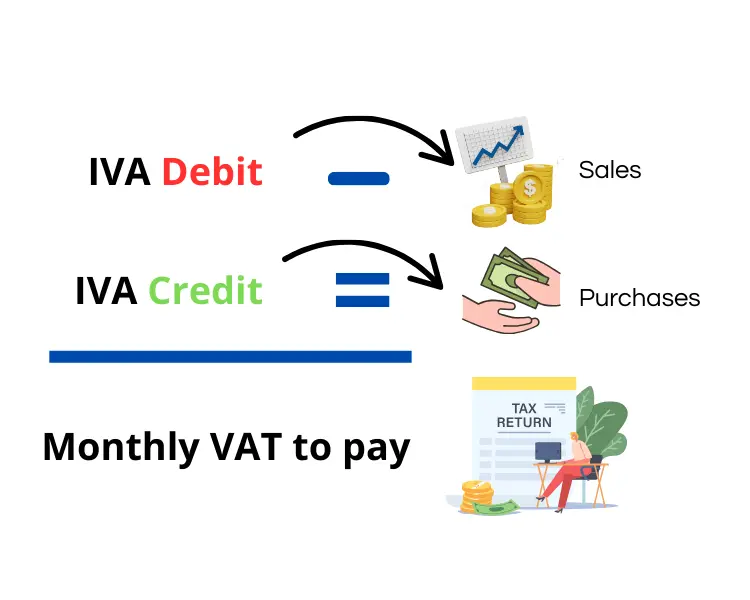

Two concepts are key: VAT credit and VAT debit.

- VAT debit occurs when you sell something. You collect IVA from the client and owe that amount to the tax authority (DNIT).

- VAT credit arises when you purchase something and pay IVA. The law allows you to deduct this from your VAT debit when filing your monthly return.

Example: You sell a table for $1,100 ($1,000 + $100 VAT). That’s $100 in VAT debit. Then you buy wood for $660 ($600 + $60 VAT). You have a $60 VAT credit. You’ll owe $40 in VAT when you file.

The Role of Invoices

To claim IVA credits and report IVA debits, all operations must be documented with an invoice. That’s why sellers ask “¿Quieres factura?” (“Do you want an invoice?”). If you say no, you lose your VAT credit. Similarly, your clients will request invoices to claim credits against their debits—especially businesses and freelancers, who are legally required to file VAT monthly.

Monthly VAT Declaration

Anyone with an active RUC (tax ID) in Paraguay must file a IVA declaration each month, regardless of whether they are an individual or company. This is done through the Marangatú platform, using Form 120. Declarations are filed for the previous month (e.g., January’s VAT is declared in February).

The due date depends on the final digit of your cédula number. If you miss a filing, you’ll need to file late and pay a fine. Until the fine is paid, you won’t be able to obtain your tax compliance certificate and your RUC will be considered non-compliant. The table presented below illustrates the deadline for your monthly IVA tax filing, according to the last number of your cédula.

| Last cédula or RUC digit | Deadline |

|---|---|

| 0 | 7 |

| 1 | 9 |

| 2 | 11 |

| 3 | 13 |

| 4 | 15 |

| 5 | 17 |

| 6 | 19 |

| 7 | 21 |

| 8 | 23 |

| 9 | 25 |

How to Pay VAT

Once your declaration is complete, you must generate a boletín de pago (payment slip) on Marangatú. You can then pay:

- Via Paraguayan bank account: Select “Pagos” > “DNIT” or “SET” > Enter your ID number. Your bank app will detect the boletín and show the amount due. One click completes the payment.

- In cash at authorized points like Maxicambios locations.

You’ll receive a confirmation email from the tax authority after payment.

VAT-Exempt and Reduced-Rate Transactions

5% IVA applies to:

- Rentals

- Interest on debts (including mortgages)

- Basic necessity goods

Exempt from IVA:

- Currency exchange

- Purchase of Paraguayan-made industrial machinery

- Export of digital services (must be internet-based and fully automated, without human input)

- Nonprofit entity operations

- Purchase of unprocessed agricultural raw materials

Important: Human-driven digital services like copywriting, social media management, or video editing are not exempt, due to the human labor involved. Conversely, automated services like app licenses, SaaS platforms, or AI tools are exempt if sold to non-residents.

Need Help With IVA Declarations?

Handling accounting for your business is a delicate matter. Even Paraguayan companies often rely on professionals—and even more so for foreigners dealing with language barriers and legal differences.

Paraguay Pathways can help. Our in-house accountants are supported by interpreters, so you can communicate in your preferred language. We can assist with both Paraguayan and international tax matters, including offshore structures and global banking strategies. Feel free to get in touch with us and we will be happy to provide an initial free consultation about your specific situation.

Footnotes

- https://www.dnit.gov.py/web/portal-institucional/w/la-dnit-cierra-el-mes-de-diciembre-con-crecimiento-del-18-8-y-el-ano-2024-con-crecimiento-record-de-20-6- ↩︎